Eligibility

Is PafGUIDE right for my organisation?

Yes, if your organisation is endorsed as a Deductible Gift Recipient Item 1 (DGR1), also known as a “doing DGR”, and therefore eligible to receive distributions from a Private or Public Ancillary Fund, also known as a “giving DGR” (DGR2). For more information on DGR status, visit the Australian Business Register webpage here.

How do I check if my organisation has DGR1 status?

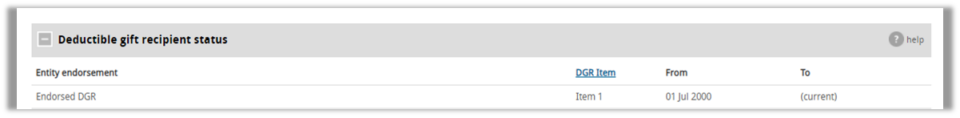

The easiest way to check if your organisation is endorsed as a DGR1 entity is to use ABN Lookup to search your organisation’s Australian Business Number (ABN), or you can also search by name. In the Historical Details tab, scroll down to the ‘Deductible gift recipient status’ section to check the item number (if any):

If your organisation is not an Endorsed DGR Item 1 and you would like to check your eligibility, visit the Australian Taxation Office (ATO) webpage here.

What if my organisation does not have DGR1 status?

As a non-DGR, your organisation may still be able to receive distributions from Private and Public Ancillary Funds through a DGR that operates to provide funding to other organisations, such as Creative Partnerships Australia (Arts), Foundation for Rural and Regional Renewal (Community), Australian Schools Plus (Education), or Australian Sports Foundation (Sports). For more information on fundraising for non-DGRs, visit the ATO webpage here.